Copy Paper Prices on the Rise

What challenges are causing this change? Find out here.

Times are certainly tough. Just when we think things are ‘returning to normal’ as employees head back to the workplace, inflation makes an untimely appearance. The price of products has been slowly trending upwards yet one beloved office supply has been making a real statement over these last twelve months: copy paper.

Wondering why prices keep going up and your favorite ream of copy paper may be out-of-stock? Here’s a few reasons why the copy paper market is so volatile:

- Paper mills have closed or scaled production

- Some mills converted production to corrugate box manufacturing

- There has been an increase in pulp prices

- Transportation costs to move materials have increased

- Supply and demand issues caused by the pandemic

Paper mill closures and converted facilities

This isn’t new news. It’s just become a more popular topic as buyers are finally noticing the after effects of their actions. Over the course of the last decade, paper mills have been downsizing and reducing production. Their strategy was first based on the trending decline of copy paper usage year over year as businesses turned towards paperless communication. Add pre-pandemic reasoning and combining it with the significant drop in demand when the pandemic first began – you’ve got a recipe for disaster. As work from home employees transitioned to digital means and the businesses that stayed open printed much less, many paper mills were faced with the decision: close permanently or ride the wave and convert their facilities to produce a product everyone was yearning for, corrugated shipping boxes.

Were you guilty of home delivery during the pandemic? Yep – so was everyone else. Some of the mills saw the opportunity and took it… many even decided not to look back. According to Giant Packaging Solutions, even when the world wants to go ‘paperless’, it cannot survive without cardboard boxes, especially at a time when e-commerce is continually on the rise.

The profitability of corrugate box manufacturing is lucrative, so why waste the time and the money to convert facilities back to copy paper production when things are going well? Take a look below at some press releases over the last few years:

- April 2022: WestRock will close Panama City paper mill on June 9th

- Auust 2021: Domtar closes 130 year old paper mill in Port Huron

- July 2021: Neenah Paper closes mill in Appleton, Wisconsin

- December 2020: International Paper sharpens focus on industrial packaging

- July 2020: Verso Corp. closes massive paper mill in Wisconsin Rapids

These are just a few of the many national changes. Now imagine larger scale shutdowns with all the international paper pulp and mill closures and their effects as imports. Not all copy paper purchased in the United States is from the United States. In 2020 alone, our country imported $15.7 billion according to Worlds Top Exports.

Raw material prices pack a punch

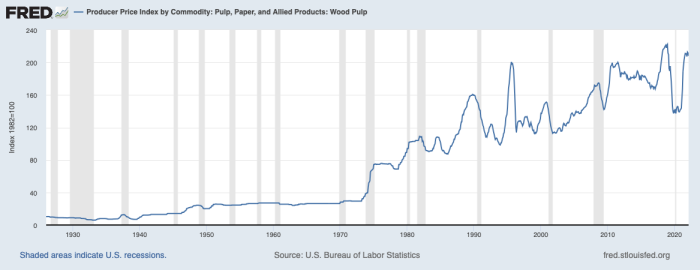

Pulp prices might have dropped when the demand went down during the pandemic; however, now that everyone wants it, its value is making a comeback. Demand greater than capacity, the mills have the advantage for setting the prices higher to cover the increased costs of the pulp. Take a look at the chart provided by FRED® showing the producer price index of pulp, paper and allied products over the last 100 years.

Wood pulp is on the rise. Just since November of 2019 to February 2022, we’ve seen an increase of 70.78, nearly up 33% over the course of the last 16 months. While supply and demand is a leading cause for this recent rise, other reports such as the continuous closures of pulp and mill plants do not relieve it.

Transportation and fuel costs

In order to create a product, raw materials must be transported to the production facility. Just the same, when it is ready to go to market, it must be transported there as well. Transportation requires planes, trains and automobiles. What do all of these have in common? They require fuel.

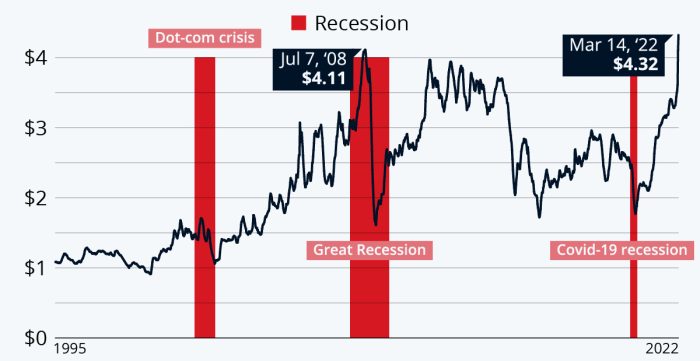

Statista reported that the COVID-19 recession has made U.S. gas prices increase to a new record high in March 2022 listing the national average as $4.32 per gallon with diesel at $5.11.

Just as you can suspect, as the price of fuel goes up, there is a waterfall effect. Sometimes it happens almost instantaneously, other times it happens behind the scenes and eventually makes its way to the end user after permeating through suppliers, manufacturers, distribution, and retail.

Supply and demand issues at a glance

Demand for paper in the United States has grown rapidly since employees have returned to the office. At the same time, capacity for production has fallen. Similar to the supply and demand of PPE products when the pandemic first began, the copy paper saga is just getting started.

According to a monthly report released by Sylvamo, referred to as the World’s global producer of uncoated paper, uncoated freesheet paper demand grew by 8.5% in February, up 4% YTD. Most significantly impacted, cutsize (our beloved copy and print) grew over 16% in February, up 11% YTD.

Looking ahead at copy paper prices

Paper prices are increasing 6-8% in April, implemented straight from our manufacturers. It should be no surprise it will continue. Industry experts like Forest2Market says we can expect to see continued volatility and uncertainty as the norm. Take a look at the chart below to see the trend of manufacturer-implemented paper prices increases over the last 12 months:

| MANUFACTURER | NOTIFICATION | PRICE INCREASE |

| Sylvamo IP* | May 1, 2022 | 6 – 9% all pack sizes |

| Domtar/Xerox | May 1, 2022 | 6 – 9% all pack sizes |

| Navigator† | February 11, 2022 | 6 – 9% all pack sizes |

| Domtar/Xerox | February 11, 2022 | 6 – 9% all pack sizes |

| Sylvamo IP* | January 1, 2022 | 4 – 6% all pack sizes |

| Barnes Paper | January 1, 2022 | 15% select products |

| American Eagle | November 1, 2021 | $4 per carton |

| Sylvamo IP* | November 1, 2021 | 6 – 9% all pack sizes |

| Navigator† | November 1, 2021 | 6 – 9% all pack sizes |

| Domtar/Xerox | November 1, 2021 | 6% all pack sizes |

| Barnes Paper | October 1, 2021 | 20% select products |

| Roaring Springs | October 1, 2021 | 12% select products |

| Sylvamo IP* | July 1, 2021 | $3 per carton |

| Navigator† | July 1, 2021 | 6 – 9% all pack size |

| Boise | June 21, 2021 | Up to 10% |

| Neenah Paper | April 25, 2021 | 5 – 8% all pack sizes |

*Sylvamo also known as International Paper includes name brands like HP, Hammermill, Relay, Springhill, and Accent Opaque paper products. **Neenah Paper includes Astrobrights®, Astroparche®, AstroDesigns®, Capital Bond®, Classic®, Creative Collection™,Environment®, Exact®, Neenah®, Neenah® Color Copy, Professional Series®, Royal Metallics®, Royal Sundance™, Southworth®, and private label products †Navigator includes Navigator, Pioneer, Discovery, and Soporset.

While this uncomfortable situation will eventually subside, Blaisdell’s is encouraging our customers to stock up now and when copy paper is available. If the SKU you normally buy becomes discontinued or out-of-stock, please contact us and our customer support team can provide a comparable alternative for you.